The UK’s financial watchdog said it wants banks to improve the way they treat political figures, after being urged by the former government to look into whether people were being unfairly debanked.

The Financial Conduct Authority (FCA) said it was following up with a handful of firms that need to make changes.

The regulator was scrutinising the treatment of so-called politically exposed persons (PEPs) following the debanking saga that unfolded last year.

It found that most firms it reviewed did not subject PEPs to excessive checks or deny them an account based on their status.

While some political figures were denied banking services or had their existing accounts closed, firms “explained this was due to financial crime reasons, not because of PEP status”, the FCA said.

This could have been because the customers did not provide the information that the banks requested – although the watchdog said it found a small number of cases where information requests were “disproportionate”.

Nevertheless, most banks and financial firms could improve the way they treat politicians and their families, the regulator concluded.

“Public service naturally comes with greater scrutiny,” said Sarah Pritchard, the FCA’s executive director of markets and international.

“But it must be proportionate and shouldn’t disadvantage people running for office or taking senior public roles, or their families,” she said.

“Most firms try to get it right but there is more they can do. We’re following up with those firms that were getting the balance wrong to ensure they make changes,” she added.

The FCA said it contacted more than 1,000 PEPs and received 65 individual responses.

It then analysed 15 banking firms, which account for about 60% of the UK current account market and include big banks and lenders.

It did not reveal which banks it had looked into. Two of the firms were mentioned 10 times each by PEPs in their responses.

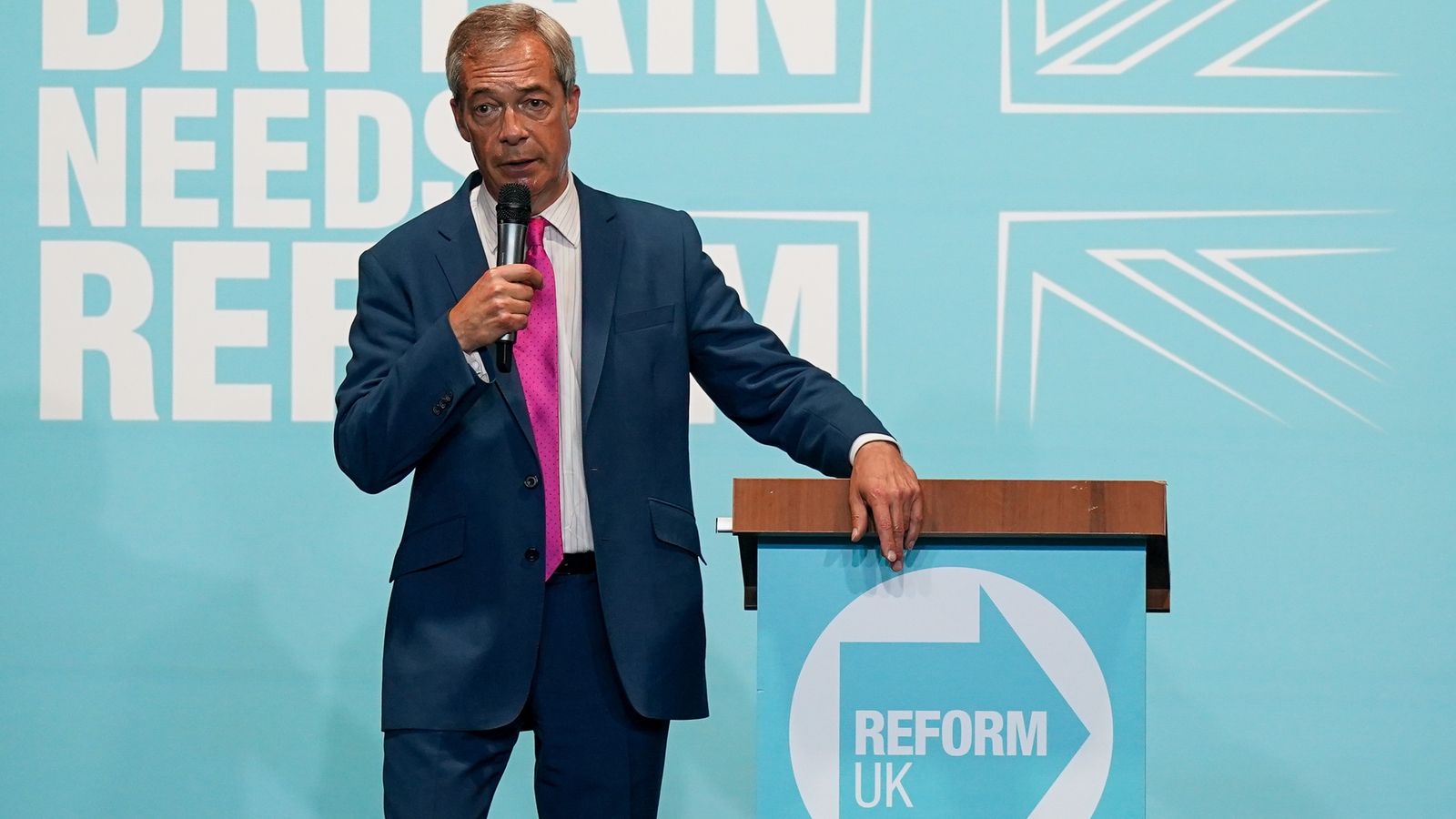

The issue of debanking came to the fore when Reform UK leader and recently elected MP Nigel Farage said he believed he had been targeted because of his status as a PEP.

It refers to people who hold public office – or their families – and are subject to extra due diligence by financial firms.

They could effectively pose more of a risk of abusing their position for personal gain, such as by making or accepting bribes, according to the FCA’s guidance from 2017.

In December, the government changed the law so that UK PEPs must be treated as “inherently lower risk” than overseas politicians.

The FCA also said today it was proposing making changes to its own guidance to reflect the new rules.