Keltbray’s Infrastructure Services Limited (“KISL” or the “Company”), a multi-disciplinary energy and transport networks specialist and engineering services provider, today announces that it has been acquired by EMK Capital, for an undisclosed sum.

The Keltbray Group (“Keltbray”) diversified into infrastructure services in 2009 with the acquisition of Gamble Rail, closely followed by that of Aspire Rail in 2010, before establishing KISL, Keltbray’s energy networks business, in 2018. KISL made further add-on acquisitions into the high voltage and renewable energy markets in 2021 and 2022 respectively.

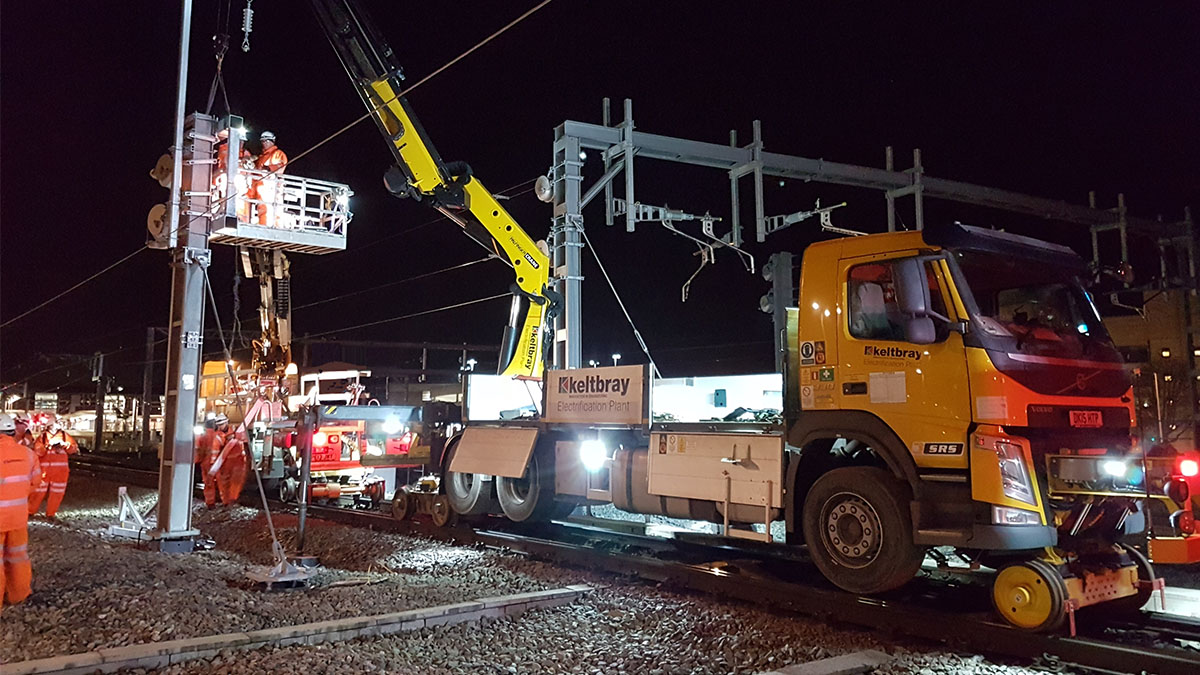

Today, KISL is a leading provider of safety-critical, highly regulated energy networks and transport services across the UK. KISL is also a key enabler of the UK’s green energy transition, with core services spanning the design, engineering, installation, maintenance, and crisis response of essential infrastructures across power, renewables, nuclear decommissioning, railways, highways and local governments.

KISL has deployed a multi-sector approach to drive impressive organic growth. The Company has built strong partnerships with a diverse base of blue-chip infrastructure network operators, leading to the twelve-fold growth of its orderbook over the last five years, which now stands at +£1.1billion. The Company also has over 1,100 dedicated, professionally accredited technical staff.

Positive long-term secular trends, including the growing need for investment in UK’s critical infrastructure assets and the broader transition towards a low-carbon, digital-enabled, and energy-secure future, will also fuel KISL’s growth.

EMK Capital will provide the financial backing and further strategic guidance to support KISL and its management team as they accelerate the Company’s ambitious growth plans. Drawing on its expertise in infrastructure and engineering services, EMK will support the Company to further strengthen its position and unlock additional growth both organically and through further acquisitions.

Darren James, Chief Executive Officer of KISL, said: “KISL is well-placed to realise our potential in the energy transition and decarbonised transport market with our strong market position and sustainable business approach.

EMK Capital’s deep understanding of the infrastructure and engineering services sector, coupled with its expertise in delivering transformational growth, will enable us to take meaningful steps towards geographic and service offering expansion, while maintaining our high-quality customer relationships and safety-driven employee culture.”

Image credit: Keltbray / Kevin Bradley