Over the last 7 days, the UK market has dropped 1.2%, but it has risen by 7.2% over the past year with earnings expected to grow by 14% per annum in the coming years. In this context, identifying high growth tech stocks like Craneware and two others can be crucial for investors looking to capitalize on sectors poised for significant expansion.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| M&C Saatchi | -14.20% | 43.75% | ★★★★☆☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £810.92 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily through its healthcare software segment, which reported $189.27 million in sales. The company focuses on developing and licensing software solutions tailored for the U.S. healthcare industry.

Craneware’s recent earnings report showed a notable increase in sales to $189.27 million, up from $174.02 million the previous year, with net income rising to $11.7 million from $9.23 million. The company’s collaboration with Microsoft Azure aims to leverage advanced AI and cloud capabilities, enhancing its Trisus Platform offerings and expanding market reach through joint marketing initiatives. With an R&D expenditure contributing significantly to innovation, Craneware is poised for continued growth in the healthcare software sector, supported by its strategic acquisitions and partnerships.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.21 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company operates globally across multiple regions including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

Genus, a leader in animal genetics, has faced challenges with revenue dipping to £668.8 million from £689.7 million and net income dropping to £7.9 million from £33.3 million over the past year ending June 30, 2024. Despite these setbacks, earnings are projected to grow significantly at 39.4% annually over the next three years. The company’s R&D expenditure of approximately $50 million underscores its commitment to innovation in genetic advancements for livestock, potentially driving future growth and industry impact.

Simply Wall St Growth Rating: ★★★★☆☆

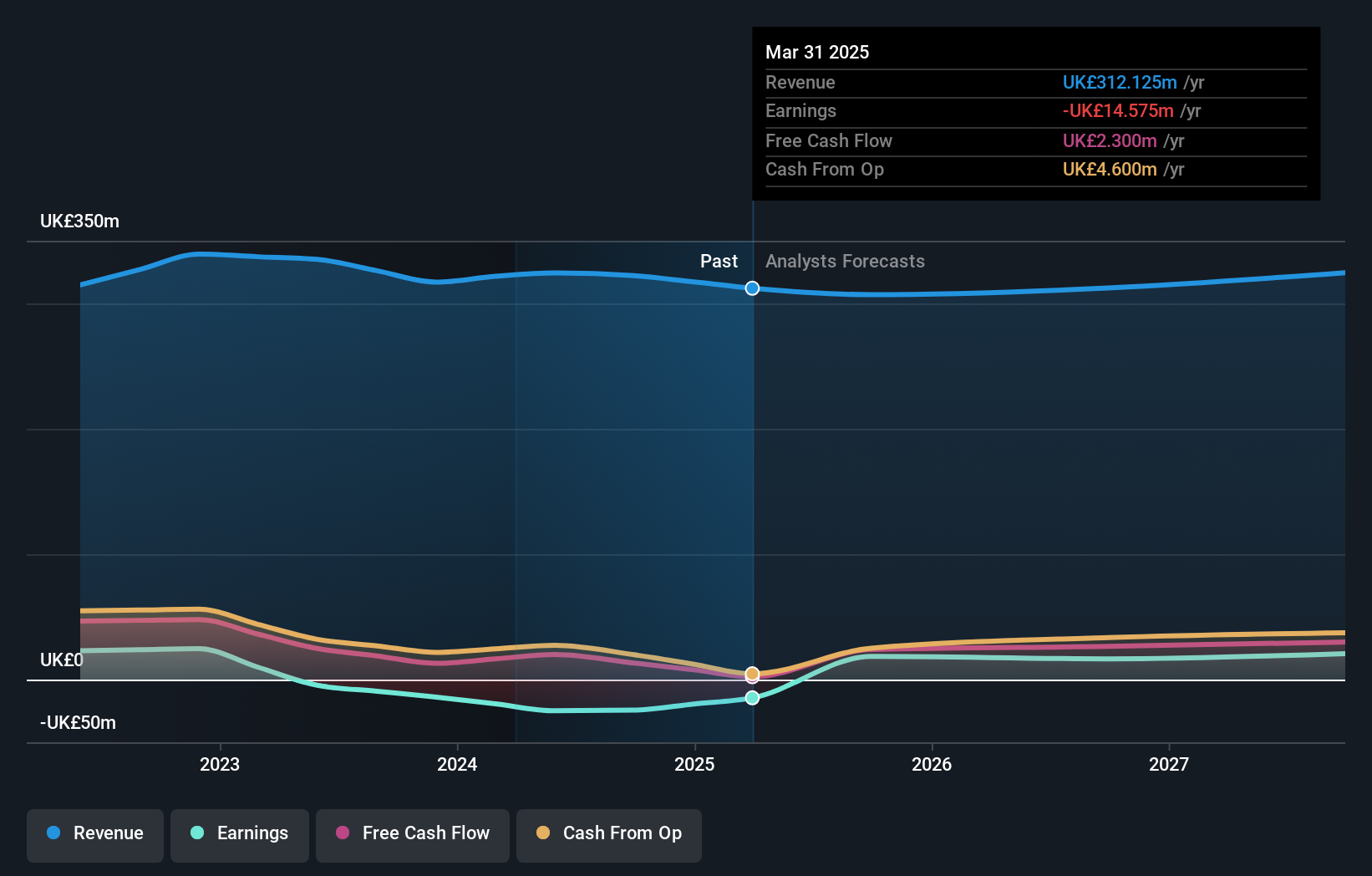

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, the Asian-Pacific, North America, and Europe with a market cap of £480.75 million.

Operations: NCC Group plc generates revenue primarily from its Cyber Security segment (£258.50 million) and Escode segment (£65.90 million). The company focuses on providing cyber and software resilience services across various regions, including the UK, Asia-Pacific, North America, and Europe.

NCC Group, a cybersecurity and risk mitigation firm, reported sales of £324.4 million for the year ending May 31, 2024, down from £335.1 million the previous year. Despite a net loss of £24.9 million, forecasts indicate an annual earnings growth rate of 87.12%. The company’s R&D expenditure highlights its dedication to innovation in cybersecurity solutions; with expected revenue growth at 4.5% per year outpacing the UK market’s 3.7%. Additionally, NCC’s recent project expansions and strategic framework agreements underscore its commitment to long-term growth and industry impact.

Where To Now?

- Embark on your investment journey to our 46 UK High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com