Westminster’s plans to alter the already cumbersome energy tax regime have sent shivers down the spines of all those concerned about the UK’s energy security, and the midstream sector is no different.

If the Chancellor greenlights what has been mooted, then from 1 November the Investment Allowance included in the Energy Profits Levy (EPL) – one of the policy’s main redeeming features – will be scrapped, the levy increased, and the sunset clause extended until 2030.

Moreover, there is a threat that some or all of the First Year Capital Allowance against the EPL will be axed.

This will not only choke spend in the sector from oil and gas producers but will also directly impact the continued investment in our country’s critical gas infrastructure, something that is needed to keep the network safe and operating at >99.9% reliability, delivering gas to power the economy.

While it may be one of the less well-understood areas of the energy chain, the importance of the midstream sector cannot be understated.

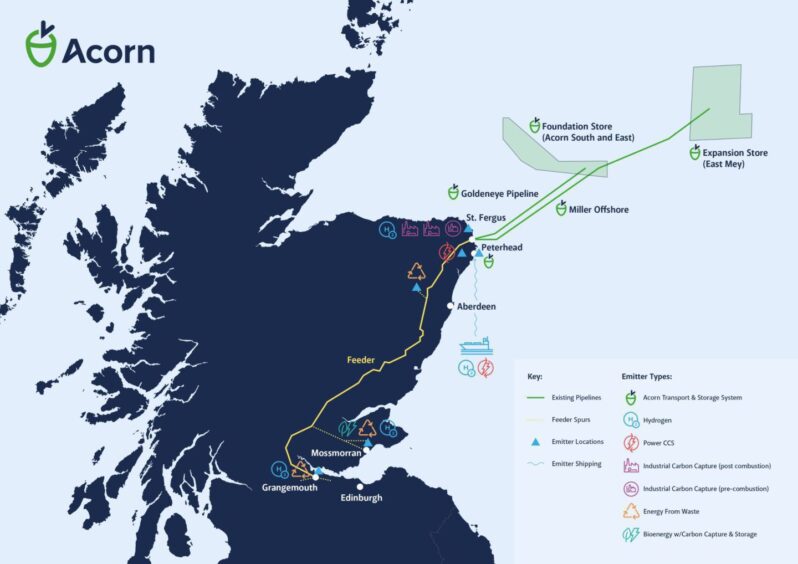

Assets operated by North Sea Midstream Partners, including nearly 600km of pipelines and facilities at St Fergus in Scotland and Teesside in England, are capable of supplying up to a quarter of UK gas demand.

As an organisation, we support the employment of over 1,000 people, and the critical infrastructure that we manage plays a vital role in processing and transporting energy resources from the North Sea to communities up and down the country, keeping homes warm and industries powered.

The UK’s energy security relies on a robust midstream network to facilitate the flow of gas, protecting against supply disruptions and geopolitical risks, and in time it will be essential for integrating and managing the variability of renewable energy.

It will also allow for facilities to be repurposed for carbon capture and storage (CCS) and hydrogen transportation, offering versatility that means the UK’s energy infrastructure will be able to adapt to future energy demands, while supporting the government’s net zero ambitions.

Energy sector looks to ‘a budget of hard decisions’

Clearly, this is going to be a budget of hard decisions, something the energy industry is no stranger to, having ridden out two major downturns in the last decade alone.

But the harsh truth is that without a more stable fiscal environment, there are grave concerns that further delays in investment decisions or withdrawals will accelerate the demise of homegrown domestic gas production.

Not only would this lead to significant job losses and reduce our energy security, but it would also do nothing to tackle global warming.

Demand for oil and gas in the UK would remain and this would need to be met, likely through importing LNG with a higher carbon footprint.

Approximately 24 million UK homes, representing over 80% of the housing stock, are currently heated using natural gas, yet domestically produced gas currently meets less than 50% of the country’s demand – and production is declining, with the UK spending over £21bn on gas imports last year.

Industry and government must collaborate to see success

Collaboration between industry stakeholders and policymakers is essential to ensure that the fiscal regime supports the energy transition and preserves energy security, whilst securing the long-term viability of the sector.

We need to have stability, with the right conditions to support continued investment in the North Sea and the infrastructure that bridges the gap between producers and consumers.

This demands a tax regime that is internationally competitive to attract and retain businesses, our supply chain and the workforce in the UK for the long term, otherwise opportunities in other parts of the world will inevitably prove too tempting for many to turn down.

The sector is committed to delivering a just and fair energy transition. NSMP is investing in projects to support this goal such as the Acorn carbon capture project at St Fergus.

However, we need industry and policymakers to get round the table and settle on a fiscal framework that preserves energy security, helps to retain businesses and investment in the UK, and supports the Government’s economic growth agenda.

Progress is being made in moving away from fossil fuels, but zeroing out emissions will take decades, and gas will continue to play an important role up to 2050 and beyond.

We owe it to the 200,000-plus people who rely on the offshore sector for work to deliver a homegrown energy transition that is managed and fair.

It is dangerous to risk this commitment in favour of perceived short-term gains which would only serve to threaten the country’s energy resilience.

Recommended for you

Swedish heat pump firm Aira expands to Scotland as part of £300m investment

© Supplied by Storegga

© Supplied by Storegga