The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China and concerns over global economic recovery. In this environment, identifying high growth tech stocks requires focusing on companies that can demonstrate resilience and innovation despite broader market pressures.

Top 10 High Growth Tech Companies In The United Kingdom

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

STV Group |

13.15% |

46.78% |

★★★★★☆ |

|

Gaming Realms |

11.57% |

22.07% |

★★★★★☆ |

|

YouGov |

14.29% |

29.79% |

★★★★★☆ |

|

Facilities by ADF |

52.00% |

144.70% |

★★★★★☆ |

|

Redcentric |

4.89% |

63.79% |

★★★★★☆ |

|

Windar Photonics |

63.60% |

126.92% |

★★★★★☆ |

|

LungLife AI |

100.61% |

100.97% |

★★★★★☆ |

|

Beeks Financial Cloud Group |

24.63% |

57.95% |

★★★★★☆ |

|

Oxford Biomedica |

20.98% |

106.13% |

★★★★★☆ |

|

Vinanz |

113.60% |

125.86% |

★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.33 billion.

Operations: Genus plc generates revenue primarily through its two main segments: Genus ABS, which contributes £314.90 million, and Genus PIC, bringing in £352.50 million. The company’s operations span multiple regions globally, focusing on animal genetics to drive its business model.

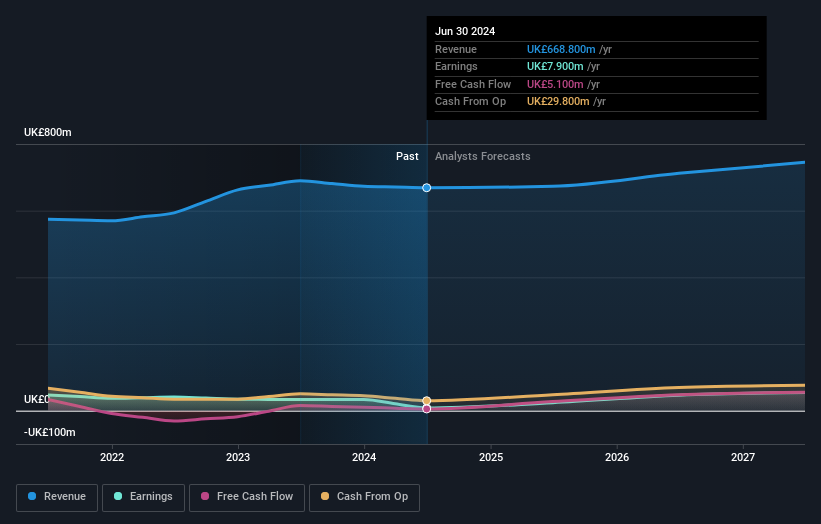

Genus plc, facing a challenging year with a significant one-off loss of £47.4M, still manages to project an impressive earnings growth trajectory at 39.4% annually, outpacing the UK market’s 14.3%. Despite this robust forecast and maintaining last year’s dividend rate at 21.7 pence per share, its recent financial performance reveals a contraction with sales dipping to £668.8 million from £689.7 million and net income falling to £7.9 million from £33.3 million previously. This juxtaposition of strong growth prospects against current financial setbacks highlights the volatile yet potentially rewarding nature of investing in high-growth tech sectors like biotechnology where Genus operates.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £537.09 million.

Operations: NCC Group plc derives its revenue primarily from Cyber Security (£258.50 million) and Escode (£65.90 million). The company’s focus on cyber and software resilience spans multiple regions, including the United Kingdom, Asia-Pacific, North America, and Europe.

NCC Group, recently added to the FTSE 350 and FTSE 250 indices, is navigating a challenging landscape with a notable forecast of becoming profitable within three years. Despite a current unprofitability status and a revenue growth prediction of 4.5% per year—slightly above the UK market average of 3.7%—the company’s strategic focus on enhancing its R&D capabilities is evident. Last year, NCC allocated significant resources to research and development, underlining its commitment to innovation in cybersecurity solutions amidst evolving digital threats. This investment in R&D not only supports future growth but also positions NCC favorably as industries worldwide heighten their focus on data security.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oxford Biomedica plc is a contract development and manufacturing organization specializing in delivering therapies globally, with a market capitalization of £400.30 million.

Operations: Oxford Biomedica generates revenue primarily from its platform segment, which accounts for £97.24 million. The company operates as a contract development and manufacturing organization, focusing on global therapeutic delivery.

Oxford Biomedica, amidst a challenging landscape, is steering towards profitability with an anticipated earnings growth of 106.1% annually. The company’s commitment to innovation is underscored by its substantial R&D expenditures, which are crucial for its strategic positioning in the biotech sector. Notably, Oxford Biomedica’s revenue is projected to surge by 21% yearly, outpacing the UK market average of 3.7%. This growth trajectory is supported by recent executive enhancements and reaffirmed financial guidance aiming for revenues between £126 million and £134 million for 2024, reflecting a robust three-year CAGR of over 35%.

Where To Now?

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:GNS LSE:NCC and LSE:OXB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com