The UK market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices both closing lower due to weak trade data from China, highlighting concerns about global economic recovery and its impact on sectors closely tied to Chinese demand. In this context, identifying high-growth tech stocks in the UK involves looking for companies that can thrive despite broader market challenges, leveraging innovation and adaptability to navigate uncertain economic conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 93.64% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, along with its subsidiaries, specializes in developing, licensing, and supporting healthcare software solutions in the United States and has a market capitalization of £710.03 million.

Operations: With a focus on healthcare software, Craneware generates revenue primarily from its software solutions segment, totaling $189.27 million.

Craneware’s strategic maneuvers, including a recent partnership with Microsoft Azure, underscore its commitment to integrating advanced cloud and AI solutions for the U.S. healthcare sector. This collaboration enhances their Trisus platform, evidenced by a 26.8% surge in past year earnings and an 8.2% annual revenue growth rate, outpacing the UK market’s 3.6%. Despite a modest forecasted Return on Equity of 12.2% over three years, Craneware is poised for robust future earnings growth at an estimated 25.6% annually, signaling strong potential amidst evolving industry demands.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of approximately £1.35 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company’s operations span multiple regions, including North America, Latin America, Europe, and Asia.

Despite a challenging year with earnings dropping significantly, Genus plc is showing resilience with a projected robust earnings growth of 39.4% annually, outstripping the UK market’s forecast of 14.2%. This optimism is tempered by a revenue growth pace of 4.1%, which, while ahead of the UK’s average at 3.6%, trails far behind the high-growth benchmarks typically seen in tech sectors. The firm continues to support shareholder returns, maintaining its dividend payout at 21.7 pence per share amidst financial headwinds marked by one-off losses totaling £47.4 million last fiscal year, impacting net margins which now stand at just 1.2%.

Simply Wall St Growth Rating: ★★★★★☆

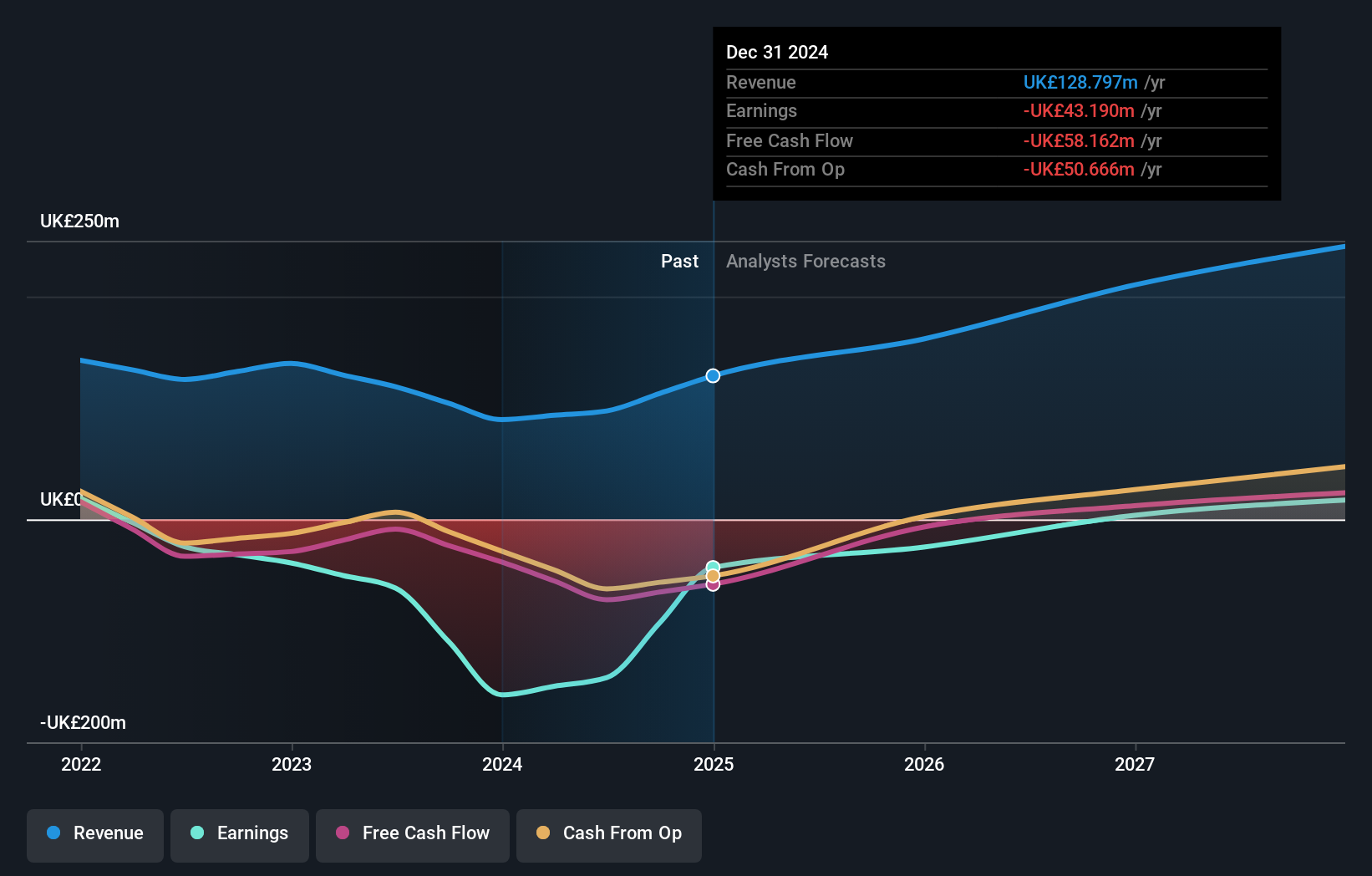

Overview: Oxford Biomedica plc is a contract development and manufacturing organization dedicated to delivering therapies globally, with a market capitalization of £405.57 million.

Operations: Oxford Biomedica focuses on the development and manufacturing of therapeutic products, generating revenue primarily from its platform segment, which accounts for £97.24 million.

Oxford Biomedica’s recent performance and strategic appointments underscore its potential in the high-growth biotech sector. With a reported revenue increase to £50.81 million for the first half of 2024 and a significant reduction in net loss from £47.96 million to £32.49 million year-over-year, the company is on a recovery path. The appointment of Lucinda Crabtree as CFO could bring fresh perspectives, given her extensive background in finance across biopharmaceuticals and investment sectors. Notably, Oxford Biomedica’s R&D expenses remain pivotal, aligning with its revenue growth forecast at an impressive rate of 21% annually over the next three years, suggesting robust future capabilities fueled by innovation and market expansion strategies.

Key Takeaways

- Dive into all 46 of the UK High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com