The United Kingdom market has experienced a flat performance over the past week but has seen a 6.6% rise over the last 12 months, with earnings projected to grow by 14% annually. In this context of steady market growth and promising earnings forecasts, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential while aligning with these overall positive trends.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company specializing in events, digital services, and academic research across the United Kingdom, Continental Europe, the United States, China, and other global markets with a market cap of £10.78 billion.

Operations: Informa generates revenue primarily through its segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company focuses on delivering events, digital services, and academic research across various regions globally.

Informa’s strategic moves in the high-growth tech sector, particularly its acquisition of Ascential plc and expansion within the Informa Festivals business, underscore its ambition to diversify and strengthen its portfolio in digital and live events. Despite a challenging year with earnings down by 11.3%, Informa is poised for recovery with projected annual earnings growth of 22.5% and revenue growth at 6.9%, outpacing the UK market average. The company’s recent repurchase of shares worth £338.9 million reflects a robust capital return strategy, enhancing shareholder value amidst these expansions.

Simply Wall St Growth Rating: ★★★★☆☆

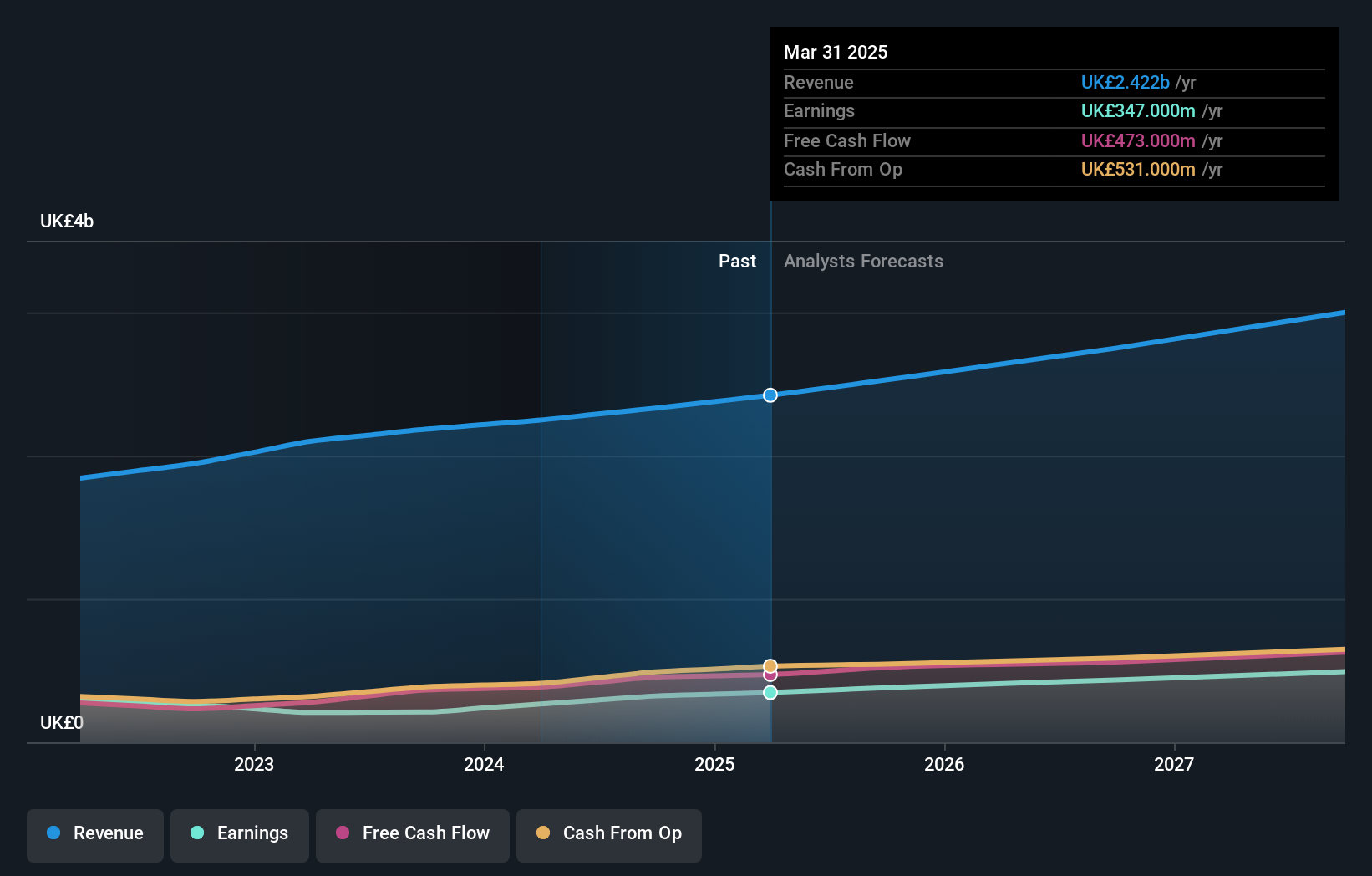

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium businesses across the United States, the United Kingdom, France, and other international markets; it has a market capitalization of £10.07 billion.

Operations: Sage Group generates revenue primarily from its technology solutions and services for small and medium businesses, with significant contributions from North America (£1.01 billion) and Europe (£595 million). The company operates across various international markets, including the United Kingdom & Ireland, which contributes £488 million to its revenue.

Sage Group’s recent strategic partnership with VoPay positions it to address efficiency gaps in SMB financial operations, a move underscored by its 9% revenue growth to £585 million in Q3 2024. This collaboration integrates advanced payment technologies into Sage’s platforms, enhancing payroll processing with features like automated direct deposits and robust security measures. With R&D expenses aligning closely with industry innovation demands, Sage invested 15.1% of its revenue back into development this year, fostering a robust pipeline for future tech advancements and maintaining competitive momentum in the high-growth tech sector of the UK.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions, including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market capitalization of £1.01 billion.

Operations: Spirent Communications focuses on providing automated test and assurance solutions, with its primary revenue stream coming from the Networks & Security segment, which generated $258.50 million.

Spirent Communications, amidst a challenging fiscal period with a net loss of $6.7 million for the first half of 2024, contrasts starkly with last year’s net income of $5.2 million. Despite these hurdles, the company is positioned for recovery with anticipated earnings growth at an impressive 40.5% annually. This outlook is buoyed by its strategic advancements in 5G Fixed Wireless Access (FWA) and Wi-Fi testing solutions, particularly through its Octobox platform enhancements tailored for emerging Wi-Fi 7 standards. These innovations are critical as they address the increasing demand from communication service providers and device manufacturers aiming to enhance user experience and network reliability in a competitive tech landscape. Notably, Spirent’s commitment to R&D remains robust, dedicating significant resources (15% of revenue) to foster developments that meet rapidly evolving market needs—ensuring their technology stays at the forefront of industry demands and customer satisfaction.

Where To Now?

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com