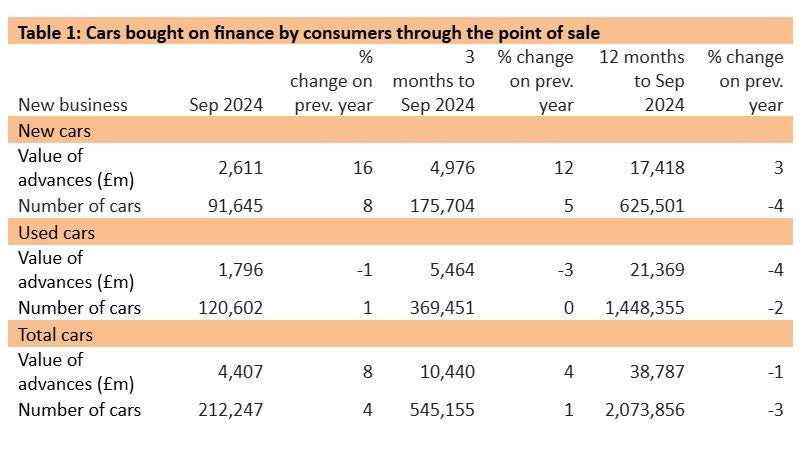

Consumer car finance new business volumes grew in September 2024 by 4% compared with the same month in 2023, according to new figures released by the Finance & Leasing Association (FLA).

The corresponding value of new business increased by 8% over the same period. In the first nine months of 2024, new business was 2% lower by volume compared with the same period in 2023.

The consumer new car finance market reported new business by value in September 16% higher than in the same month in 2023, while new business volumes grew by 8%. In the nine months to September 2024, new business volumes in this market were 3% lower than in the same period in 2023.

The consumer used car finance market reported a fall in the value of new business in September of 1% compared with the same month in 2023, while new business volumes grew by 1%. In the nine months to September 2024, new business volumes in this market were 1% lower than in the same period in 2023.

Geraldine Kilkelly, Director of Research and Chief Economist at the FLA, said: “Overall, the consumer car finance market reported growth in both the value and volume of new business in September which saw the issue of a new registration plate. In Q3 2024 as a whole, new business volumes in this market were 1% higher than the same quarter in 2023.

“The consumer car finance market is the largest of the UK consumer credit markets accounting for 36% of the total value of outstanding consumer credit contracts at the end of September 2024. It currently helps more than 6 million consumers fund car purchases across all regions of the UK.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Thank you!

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”