As the United Kingdom’s FTSE 100 index faces pressure from weak trade data out of China, reflecting broader global economic challenges, investors are closely monitoring the impact on sectors tied to international markets. In this environment, identifying high growth tech stocks becomes crucial as they often demonstrate resilience and innovation-driven potential amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the UK, US, Australia, and other international markets with a market cap of £819.37 million.

Operations: With a market cap of £819.37 million, GB Group generates revenue through three main segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million).

GB Group, navigating through a challenging tech landscape, demonstrates a nuanced growth trajectory with its revenue forecast to expand by 6.3% annually, outpacing the UK market average of 3.5%. Despite current unprofitability, the firm is poised for a robust turnaround with earnings expected to surge by approximately 89.8% per year. This optimism is underpinned by significant R&D investments that underscore GB Group’s commitment to innovation and sector leadership in identity verification solutions. Moreover, the recent declaration of a dividend increase to 4.20 pence signals confidence in sustained financial health and shareholder value enhancement moving forward.

Simply Wall St Growth Rating: ★★★★☆☆

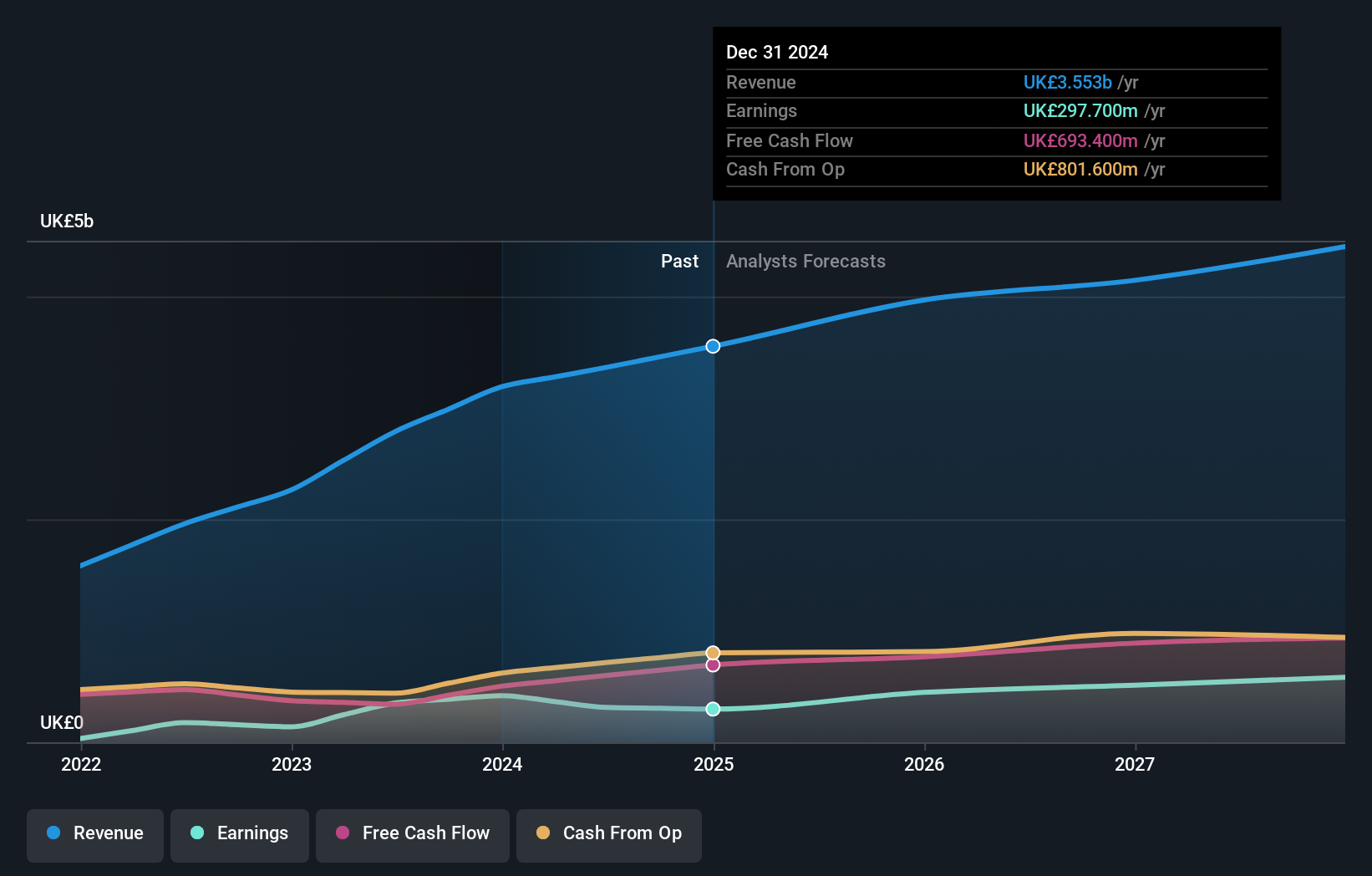

Overview: Informa plc is an international company based in the United Kingdom that specializes in events, digital services, and academic research across various global regions, with a market capitalization of approximately £11.08 billion.

Operations: Informa generates revenue primarily from four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates across the UK, Continental Europe, the US, China, and other international markets.

Informa, navigating a dynamic media landscape, projects an annual revenue growth of 7.6%, outstripping the UK’s average of 3.5%. This growth is bolstered by a robust forecast in earnings, expected to surge by 22.5% annually. Despite recent challenges marked by a significant one-off loss of £213.5 million, Informa’s strategic expansions and partnerships, notably with Monaco and the acquisition aimed at enhancing its Informa Festivals business, underscore its adaptive strategies in high-stakes markets. Additionally, the firm’s commitment to shareholder returns is evident from its aggressive share repurchase program totaling £1.3 billion since March 2022 and a consistent dividend payout, reflecting confidence in its financial trajectory and operational strategy.

Simply Wall St Growth Rating: ★★★★☆☆

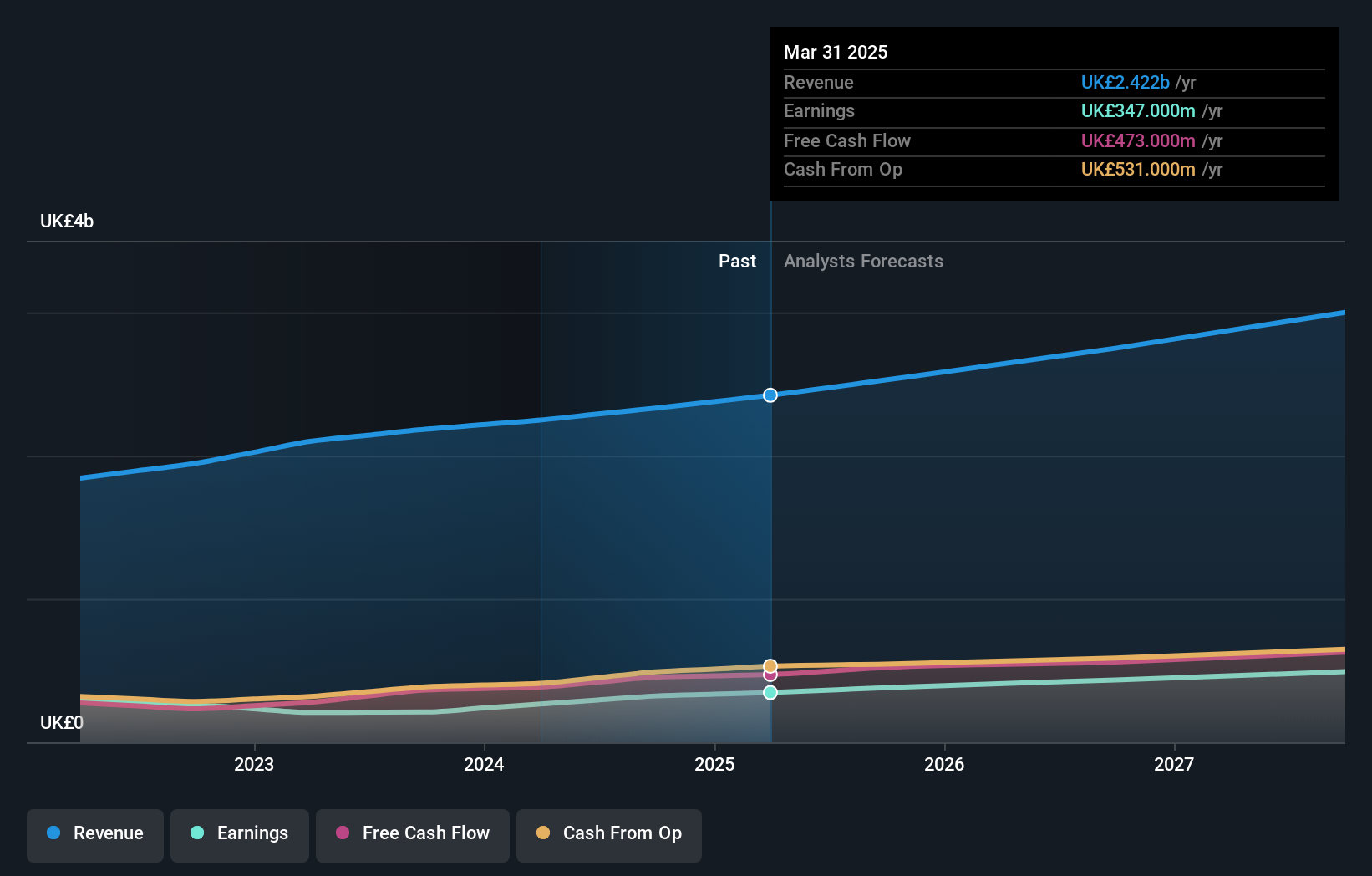

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium businesses across the United States, the United Kingdom, France, and other international markets with a market capitalization of £10.37 billion.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions for small and medium businesses across these regions.

Amidst a promising financial landscape, Sage Group stands out with its robust revenue growth forecast of 7.7% annually, significantly outpacing the UK’s average of 3.5%. This growth is complemented by an even more impressive earnings projection, expected to surge by 15.1% each year. The company’s dedication to innovation is evident in its R&D investments, which have consistently accounted for a substantial portion of its revenue, positioning it well within the competitive tech sector. Recent strategic moves include a partnership with VoPay, enhancing Sage’s Business Cloud Payroll system through advanced payment technologies that address critical efficiency issues in SMB financial operations. This collaboration not only streamlines processes but also fortifies Sage’s commitment to integrating cutting-edge solutions that cater to evolving business needs.

Where To Now?

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com