The UK market has been experiencing turbulence, with the FTSE 100 closing lower due to weak trade data from China and a faltering global economy. In this context, identifying high-growth tech stocks becomes crucial as they often demonstrate resilience and potential for significant returns even amid broader market challenges.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.30% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 83.65% | 88.65% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Seeing Machines | 24.29% | 94.35% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our UK High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

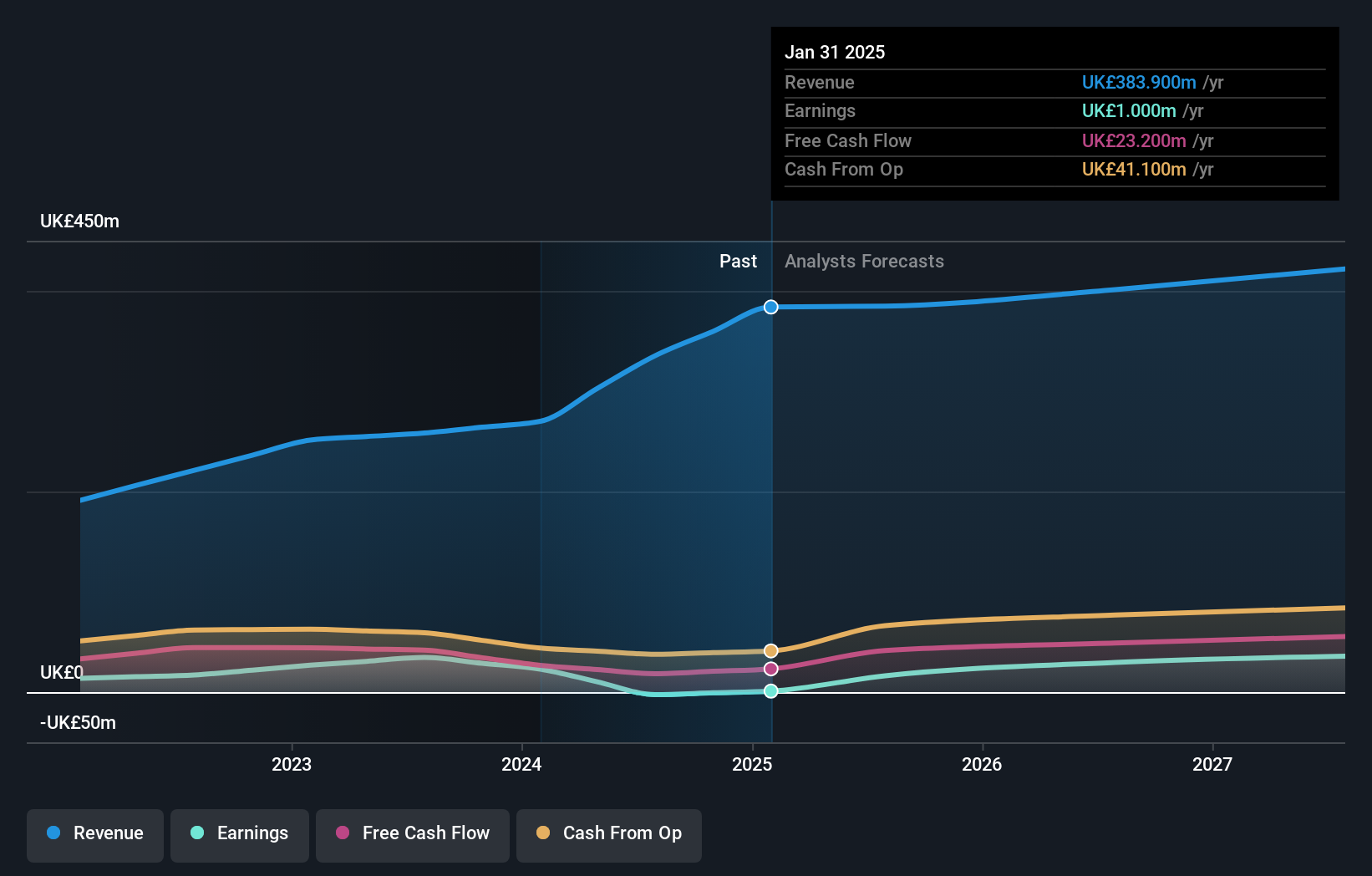

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers and has a market cap of £395.50 million.

Operations: Nexxen International Ltd. generates revenue primarily through its marketing services, amounting to $334.69 million. The company operates an end-to-end software platform that facilitates connections between advertisers and publishers in Israel.

Nexxen International’s recent partnership with Vevo aims to expand its programmatic footprint, leveraging a vast inventory of 900,000+ music videos and driving additional demand through direct relationships. The company reported Q1 2024 sales of $74.43 million, up from $71.74 million a year ago, while reducing net loss to $6.87 million from $17.91 million. With R&D expenses representing 8% of revenue and earnings forecasted to grow by 116%, Nexxen is positioning itself for substantial future growth in the tech sector.

Simply Wall St Growth Rating: ★★★★★☆

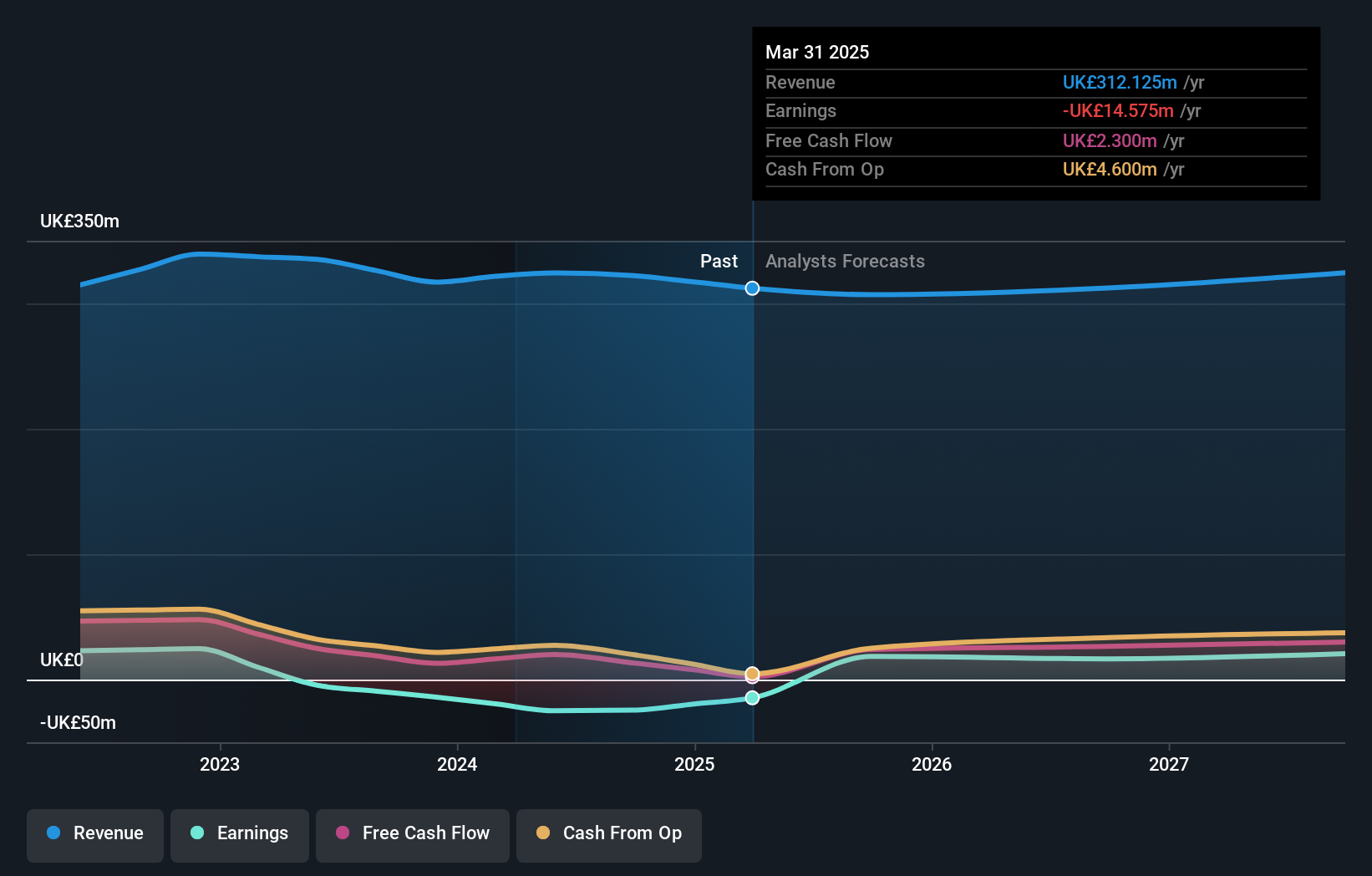

Overview: YouGov plc provides online market research services across the United Kingdom, the United States, the Middle East, Mainland Europe, and the Asia Pacific with a market cap of £652.33 million.

Operations: YouGov plc generates revenue primarily from its Data Products segment, which accounts for £85.10 million. The company operates across various regions including the UK, US, Middle East, Mainland Europe, and Asia Pacific.

YouGov’s recent executive appointments, including Marc Ryan as Chief Product Officer, signal a strategic focus on enhancing its audience intelligence and brand tracking products. The company forecasts annual earnings growth of 29.8%, significantly outpacing the UK market’s 14.3%. With revenue expected to grow by 14.3% per year, YouGov is poised for robust expansion. R&D expenses accounted for £32 million in the last fiscal year, underscoring their commitment to innovation and product development in a competitive tech landscape.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience industry across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £493.27 million.

Operations: NCC Group plc generates revenue primarily from its Cyber Security segment (£258.50 million) and Escode segment (£65.90 million). The company operates in multiple regions, including the UK, Asia-Pacific, North America, and Europe.

NCC Group’s revenue is forecast to grow 4.5% annually, outpacing the UK market’s 3.7%. Despite a net loss of £24.9 million for the year ending May 31, 2024, and an unprofitable status currently, NCC is expected to become profitable within three years. The company has repurchased shares in the past year and declared a dividend of 3.15 pence per share for October 2024, amounting to approximately £10 million. R&D expenses are significant at £32 million last fiscal year, highlighting their commitment to innovation in cybersecurity solutions amidst evolving digital threats.

Make It Happen

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Nexxen International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com