The United Kingdom’s stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting concerns about global economic recovery and its impact on commodity-dependent sectors. In such a fluctuating environment, identifying high-growth tech stocks like IDOX and others can offer potential opportunities for investors seeking resilience and innovation amidst broader market uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Windar Photonics | 42.38% | 56.12% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| YouGov | 8.52% | 55.02% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Seeing Machines | 21.40% | 97.67% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our UK High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IDOX plc offers software and services to manage local government and other organizations across the UK, US, Europe, and internationally, with a market cap of £273.64 million.

Operations: The company generates revenue primarily from three segments: Assets (£14.75 million), Communities (£14.99 million), and Land Property & Public Protection (£50.91 million).

IDOX is navigating a transformative phase with strategic executive appointments and robust financial forecasts, signaling potential in the high-growth tech sector. Recently, the company projected a significant revenue increase to approximately £87.6 million for FY 2024, up about 20% from the previous year, with recurring revenues also rising to around £54 million. These figures underscore IDOX’s commitment to strengthening its market position through innovation and leadership in geospatial and digital technologies. Moreover, their R&D investments are pivotal in supporting this growth trajectory; however, specific R&D expenditure figures were not disclosed. With new leadership like Alex Wrottesley at the helm of its Geospatial Division and an expected annual earnings growth of 22.8%, IDOX is strategically poised to capitalize on expanding tech demands while enhancing shareholder value through focused operational strategies.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers in Israel, with a market capitalization of £529.75 million.

Operations: The company generates revenue primarily from its marketing services segment, which amounts to $349.11 million.

Nexxen International has demonstrated a robust turnaround, with sales surging to $90.18 million in Q3 2024 from $80.09 million the previous year, reflecting an 8.7% increase. This growth is complemented by a significant recovery in net income to $14.54 million, reversing a loss from the same period last year. The company’s commitment to innovation is evident in its recent launch of Deal Marketplace within its demand-side platform, enhancing ad campaign efficiency and data utilization for advertisers. Additionally, Nexxen’s aggressive share repurchase strategy, buying back shares worth nearly $50 million, underscores its confidence in sustained growth and shareholder value enhancement.

Simply Wall St Growth Rating: ★★★★☆☆

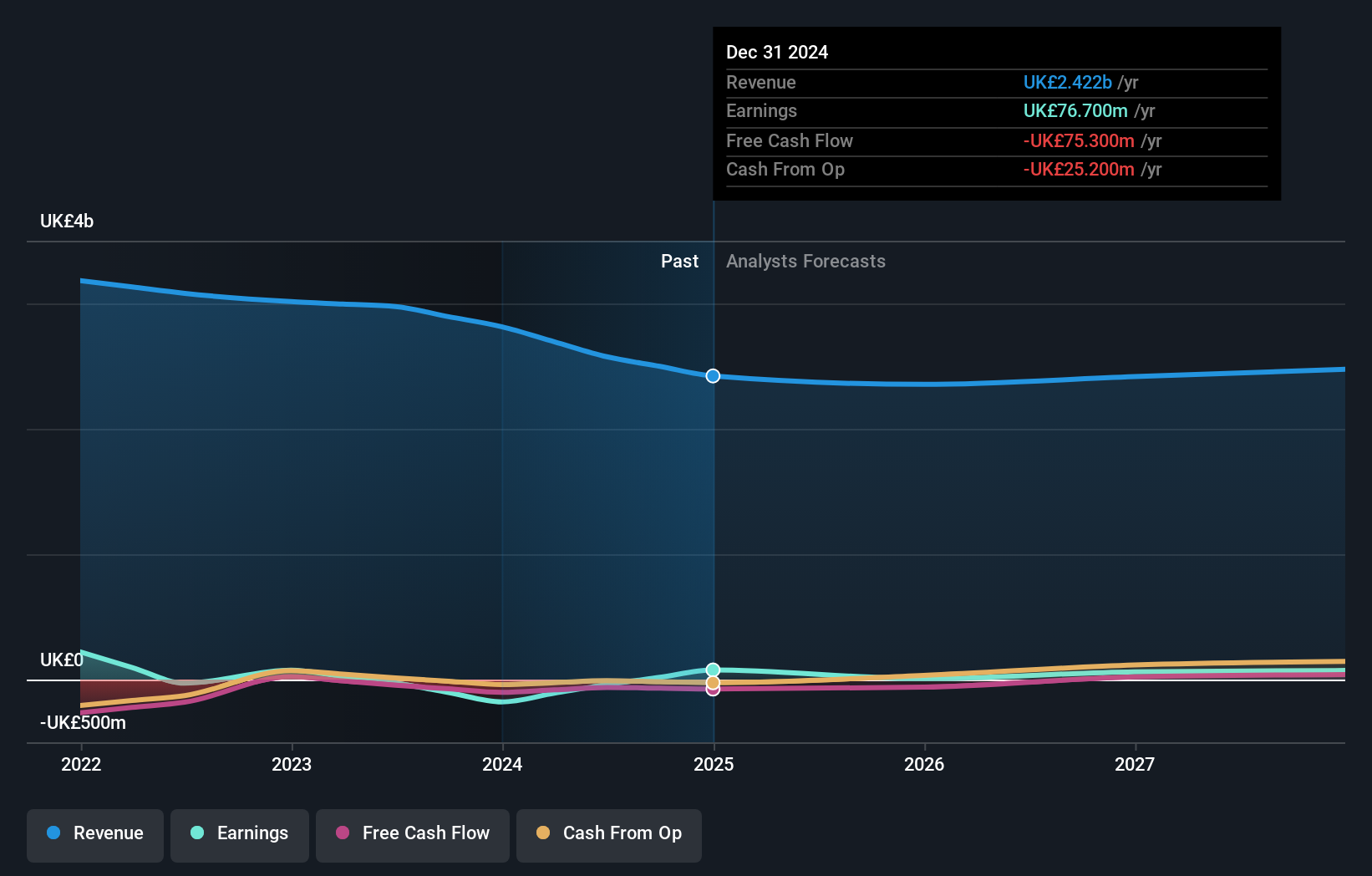

Overview: Capita plc is a company that offers consulting, digital, and software products and services to both private and public sector clients in the UK and globally, with a market cap of approximately £285.80 million.

Operations: Capita generates revenue primarily through its Capita Experience and Capita Public Service segments, contributing £1.12 billion and £1.49 billion respectively.

Capita, amid a transformative phase, is poised to leverage its strategic roles in the UK’s tech landscape. The firm has secured a lucrative extension worth up to £135 million to manage the UK’s smart meter communications, underpinning its pivotal role in national infrastructure projects. This aligns with an anticipated earnings growth of 44.9% per year, showcasing Capita’s potential despite current unprofitability and modest revenue growth projections of 1.3% annually. Moreover, the recent appointment of Jack Clarke as Independent Non-Executive Director brings seasoned financial expertise to Capita’s board, promising enhanced governance as they navigate these expansive contracts and aim for profitability within three years.

Key Takeaways

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com