INFINOX Capital Limited, the London based, FCA regulated arm of global online brokerage INFINOX, has released its financial results for FY 2024 (March 31 fiscal year end), indicating a return to profitability for the company as it shifts its focus to institutional business.

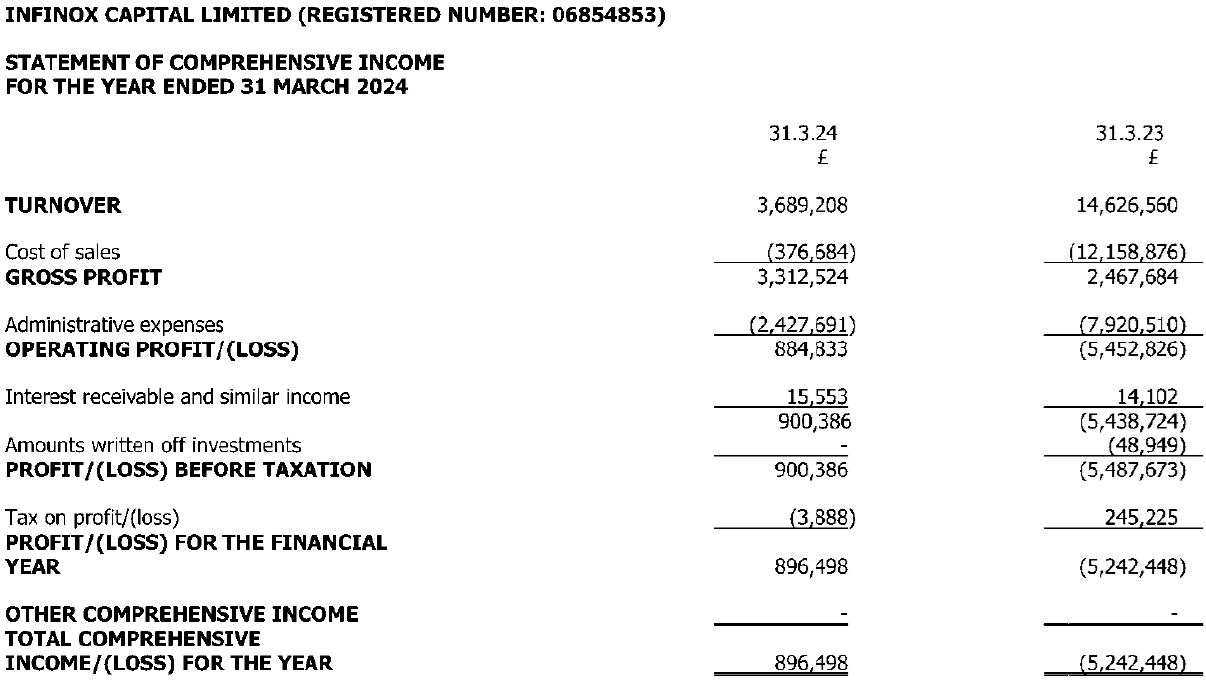

Revenues for INFINOX Capital came in at £3.7 million in FY 2024, down from £14.6 million last year as the company decided to close its retail operations in the UK to pursue institutional business under the IXO Prime brand. That decision led to a reduction of client assets under management of 65% and a revenue reduction of 75%. However these decisions have allowed profits to increase significantly, as the company held a strong position within the industry.

Net profit at INFINOX Capital came in at £0.9 million for FY 2024, versus a £5.2 million loss in 2023.

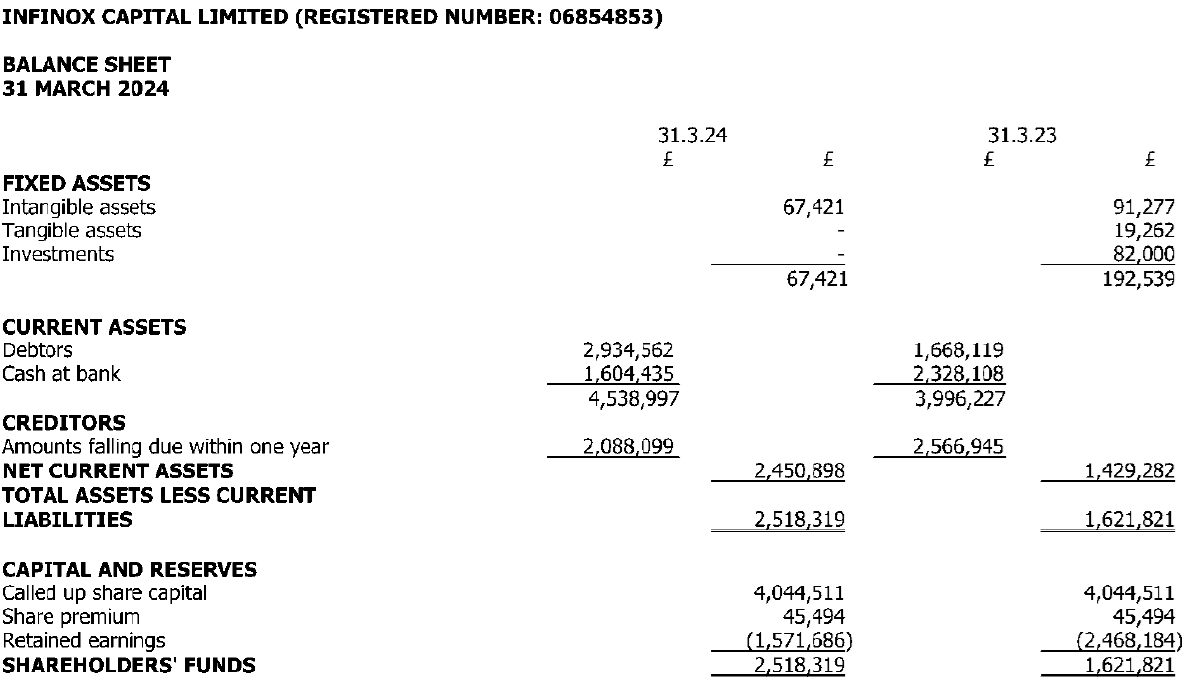

The company said it will continue to develop the IXO Prime business brand, which offers liquidity and institutional services to brokers, money managers, professional clients and fintech companies. The business remains well capitalised to take advantage of any other future opportunities.

INFINOX Capital added that a new leadership team has been appointed to steer the company towards its strategic growth ambitions, with the transition including the departure of longtime CEO Robert Berkeley and Jay Mawji appointed as CEO. Jana Zdravecka has joined as Executive Director, Daniel Skowronski as Director and Lee Holmes has returned in an executive management role.

Jay Mawji, CEO of INFINOX Capital said,

Jay Mawji, CEO of INFINOX Capital said,

“Our steadfast commitment to doing the simple things very well may seem boring to some – but we see it as vital to our recipe for success. The strong performance from our FCA business and impressive KPIs for the wider group indicate that our strategy is working and with the investment and resources from the new shareholders we are well positioned to achieve our ambitions.”

Jana Zdravecka, Executive Director of INFINOX Capital said to FNG,

Jana Zdravecka, Executive Director of INFINOX Capital said to FNG,

“INFINOX has undergone significant restructuring over the past year. This has involved streamlining operations, reducing costs, and making strategic decisions to exit non-profitable business lines from previous years. We are now focused on strengthening our offerings to institutional clients and re-investing our efforts in this area, which we will expect will enhance long-term profitability.”

INFINOX Capital’s FY 2024 income statement and balance sheet follow below.