Getty Images

Getty ImagesUS chip-maker Intel has said it plans to cut more than 15,000 job cuts as it seeks to revive the business and catch up with competitors.

Shares in the company plunged by up to 20% after it announced the measures, and also reported falling sales.

The news from Intel also hit other shares in other tech giants, and contributed to a sharp fall in Asian stock markets.

Japan’s Nikkei share index closed down 5.8%, the largest percentage fall since March 2020 at the start of the pandemic, with Japanese tech firms among the biggest losers.

The Nikkei ended the day down 2,216.63 points at 35,909.70, the second-biggest points drop in its history, with worries about the strength of the US economy also affecting stocks.

A downbeat survey of US manufacturing firms triggered fears the economy is weakening, and has increased interest in the latest US jobs figures that are due out later on Friday.

The three major share indexes in the US closed lower on Thursday, and shares in big names, including Amazon, continued to fall in after-hours trade.

Amazon shares dropped more than 4%, after the e-commerce giant reported a 10% rise in sales to $148bn.

That marked a slowdown from the prior quarter and it forecast further weakening in the months ahead, putting pressure on margins, even as the firm ramps up investments in areas such as artificial intelligence (AI).

‘Bolder actions’ needed

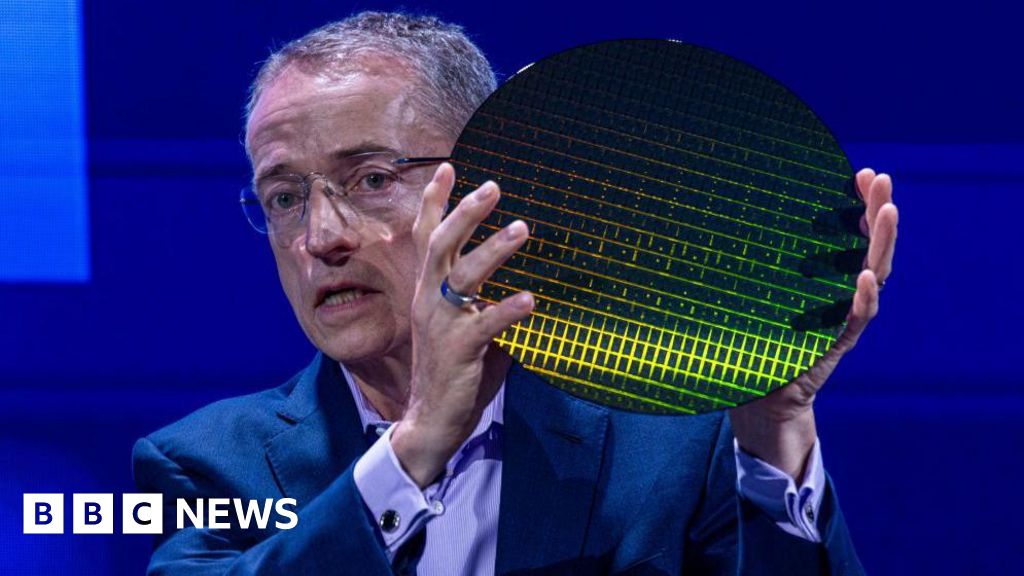

Intel has been struggling as businesses turn to rivals such as Nvidia, known for its powerful AI chips.

The company said sales fell 1% year-on-year in the three months to June and warned that the second half of the year would be worse than expected.

“Our revenues have not grown as expected – and we’ve yet to fully benefit from powerful trends, like AI,” chief executive Pat Gelsinger wrote in a memo to staff.

He said the situation required “bolder actions” and the firm had to “fundamentally change the way we operate”.

Intel has slashed investment plans and also said it would suspend dividend payments.

“It’s really having to pull back on spending on its data centres and it’s struggling to take market from other providers, so it’s a real shock to the market,” Lucy Coutts, investment director at JM Finn, told the BBC.

There was better news from Apple, which saw sales rebound in spring, overcoming weakness in China and a dip in iPhone sales.

Revenues in the three months to June were $85.8bn (£67.3bn), up 5% year-on-year and marking a return to growth after a slump at the start of 2024.

Apple said it was well positioned to benefit from the increased use of AI, as AI-powered improvements to the company’s software convince customers to upgrade their devices.

The company recently released some of the new features, branded as “Apple Intelligence”, to developers in the US.

The new system makes it easier for iPhone users to record and transcribe phone conversations, generate personalised emojis while messaging and interact more conversationally with the company’s voice assistant, Siri, among other changes.

“We remain incredibly optimistic about the possibilities of AI and we will continue to make significant investments in this technology,” said Apple boss Tim Cook.

Over the April to June period, sales of iPhones slipped 1%, a drop outweighed by increased sales of Macs and iPads.

Apple also reported an all-time record in revenue from its services division, which includes offerings such as Apple Pay and Apple News.