BBC

BBCThe “red-hot” rental market is starting to cool, exclusive data provided to the BBC reveals, but tenants say they are still caught in a price trap.

The cost for renters who move home and take on a new tenancy has risen at its slowest rate for nearly three years, according to property portal Zoopla.

But it is still going up, and 17 prospective tenants on average are chasing every available home.

The picture also varies considerably in different areas. One couple in Birmingham said they felt “defeated, isolated, panicky and angry”.

“It’s hard to stay motivated at work when it feels like all of the hard work that you do is just to keep your head above water,” said Mike Buller, who is aged in his 40s and lives with his wife Lisa.

Rent rises for new lets – people moving home to take on a new tenancy – have slowed in the UK’s second largest city but – as in the vast majority of areas – are still going up.

The couple, who are trying to save to buy their own home, said only a big drop in rents would have a noticeable impact.

The Zoopla data, shared with the BBC, shows that affordability of renting has improved, with rent rises for newly-let homes now roughly on a par with increasing earnings. The data does not include those people who are renewing a rental agreement in existing properties.

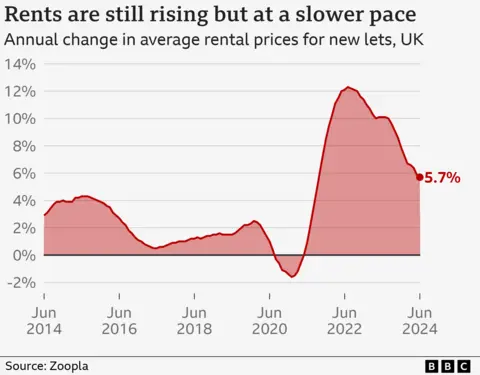

The 5.7% increase in UK rents in the year to the end of June was the slowest rise recorded since September 2021, the data suggests.

The cost went up by only 1.6% in the first six months of this year – again the slowest rise during any half year for three years.

“We have moved from a red-hot market over the last couple of years, to one which is still hot, but cooling,” said Richard Donnell, executive director at Zoopla.

Despite the slowdown, renting is still 20% more expensive than a couple of years ago, he said, forcing some tenants to share with other tenants or lower their expectations.

Less intense competition is partly behind the slowdown. Last year, about 30 to 35 tenants were chasing every available property. That has dropped to 17, according to Zoopla figures, but that is still two or three times the level of competition seen before the pandemic.

Various lettings agencies have also reported shorter queues to view.

A number of factors are at play when it comes to falling demand, with students and graduates among the key drivers.

A drop in student numbers, partly those from overseas, has lowered competition in some areas. Meanwhile, some graduates – spooked by the costs involved – have moved back into the family home.

“About 80% of my friends finished university and went straight home to live with their parents,” said Monty Savage, who shares a flat with his cousin in Nottingham.

He graduated last year, has a job, and after he has paid his rent of £1,100 a month, relies on his parents to help financially with other bills.

Separate research from estate agency Savills suggests parental support continues into homeownership. Its analysis of industry data found that 57% of first-time buyers – a total of 164,000 – had family assistance in buying their first home with a mortgage in 2023. That was the highest proportion for 11 years.

Postcode differences

Renters moving home in Monty’s home city of Nottingham saw prices actually falling slightly in the first half of the year compared with the same period in 2023, according to the Zoopla study.

The cost of rents in Brighton, London and Glasgow also dipped.

Mr Donnell said local markets differed, with some seeing more investment in rental property, and some having “overshot” with rising rents. That meant they had to fall to become affordable for prospective local tenants.

On the flipside, some first-time buyers had seen mortgage rates fall sufficiently to be able to stop renting and buy a home.

In Derby, despite the proximity to Nottingham, rents are increasing. Imogen Pearson said the intensity of competition had been ridiculous. She said she had lost out on some properties because people paid a deposit before even going to a viewing.

“I would understand that in somewhere like London or Manchester, but not in the suburbs of Derby,” she said.

“The more money you spend, the longer you have to rent.”

Ultimately, the number of properties available to rent has failed to grow since 2016, according to Mr Donnell, while demand has risen – hence the rising costs for tenants.

Despite a 39% fall in rental demand in the past year, he said the situation would only become more affordable for those on low incomes or reliant on benefits when more homes become available.

In the meantime, people have to hunt around, work out what they can afford and where, and talk to local agents with knowledge about what is available.

Zoopla bases its figures on its listings data, which covers about 80% of homes listed for let.

How you can get to the front of the renting queue

Agents say there are some simple ways to make it easier to secure a rental property, including:

- Start searching well before a tenancy ends and sign up with multiple agents

- Have payslips, a job reference, and a reference from a previous landlord to hand

- Build up a relationship with agents in the area, but be prepared to widen your search

- Be sure of your budget and calculate how much you can offer upfront

- Be aware that some agents offer sneak peeks of properties on social media before listing them

There are more tips here and help on your renting rights here.