By Harrison Jones, BBC News

BBC

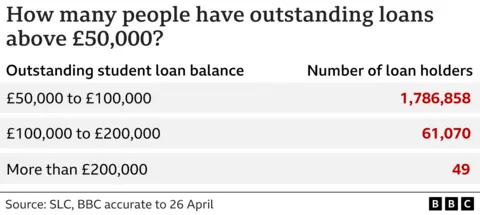

BBCAlmost 1.8 million people are now in at least £50,000 of UK student debt, data obtained by BBC News reveals.

More than 61,000 have balances of above £100,000, figures from the Student Loans Company (SLC) also show, while another 50 people each owe upwards of £200,000.

The statistics were released after a Freedom of Information (FOI) request for the number of loan holders with above average debts who are eligible to start repayments.

The SLC previously said the average balance for loan holders in England when they start making repayments was less than £45,000. New government data shows that amount has now risen to £48,470.

Balances can be significantly higher for those who study multiple or lengthy courses and often rise rapidly with interest.

In 2023/24, some 2.8 million people in England made a student loan repayment, according to government figures released after the FOI response.

That means only a small fraction of those repaying their balances are in more than £100,000 of debt – but the majority do owe more than £50,000.

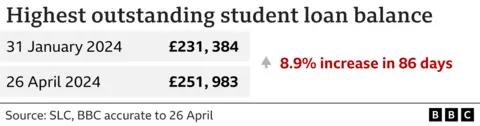

It comes after the BBC revealed earlier this year that the highest UK student debt was more than £231,000. Around three months later, that figure has now hit £252,000.

Tom Allingham, from website Save The Student, said such balances were “alarming” but were “in no way indicative of the norm”.

Personal finance expert Martin Lewis told the BBC the debts should be seen more like a “limited form of graduate tax”.

Speaking on Radio 4’s Today programme, he explained: “Student finance for the vast majority of students is not about what you owe, but what you earn – you repay 9% of everything above a threshold.”

For example, those on “Plan 2 loans” would pay 9% of everything earned over £27,295.

The National Union of Students (NUS) branded it “ridiculous” that none of the main parties are offering “reform” of student finance in the election campaign.

Debts are written off at the end of loan terms, regardless of how much is owed by that point. The terms are often 30 or 40 years, but depend on your course and start date.

Heavily-indebted graduates have also spoken to BBC News about their concerns with the current system.

Titi, a senior electrical engineer from Croydon who asked for his full name not to be used, saw his student debt – which stands at more than £128,200 – rise by £788.11 between 6 April and 6 June this year.

“No matter how much I pay it is always increasing,” he said, referencing the near 8% interest rate on accounts like his, which is driven by high inflation.

The father-of-one, 43, told the BBC he feels it is impossible to pay back the balance in full following his four-year course at London South Bank University and two years studying for a Higher National Diploma.

“It seems like a money-making avenue when you look at the (interest) rates applied to the loans,” he said.

Titi said he fears some people may be discouraged from higher education “when they do the calculations” and consider what they could earn without a degree.

Titi

TitiIt is more than 10 years since tuition fees were tripled in England. From 2017, fees have cost a maximum of £9,250 per year across the UK, though in Scotland, Scottish students are charged a maximum of £1,820 and in Northern Ireland, the current maximum tuition fee for full-time undergraduates is £4,710.

Many people who borrowed “exceptional amounts” on so-called “Plan 2” loans – which were introduced when fees were tripled – are unlikely to pay the full amount back, according to Ben Waltmann, from the Institute for Fiscal Studies.

But Claire Callender, a professor of higher education policy and deputy director of the Centre for Global Higher Education, told the BBC that owing such high amounts is “likely to have a negative impact on graduates’ lives”.

It is not clear whether the largest debt now known to the SLC – of £252,000 – is on the same loan as the one revealed to be the highest in March, at £231,000.

Nick Hillman, the director of the Higher Education Policy Institute, told the BBC he was “most shocked” by the number of people in more than £200,000 of student debt.

He pointed out that the data suggests that fewer than 50 people owe at least £10m between them.

“Clearly, at that level, the student loan system is not working well because these people will not pay it all back”, Mr Hillman said.

‘People will not pay it all back’

In its response to the FOI request, the SLC said people with higher than average balances “may be in receipt of several student loan products”, including an Advanced Learner Loan for further education courses and funding for undergraduate courses, postgraduate Master’s courses and postgraduate Doctoral courses.

It said other factors behind high student debts could also include loan holders studying multiple or lengthier courses or holding more than one loan plan type. The company added that some students receive additional funding due to “compelling personal reasons”.

Despite being in more than £101,500 of debt, foundation year 2 doctor Abbie Tutt is pleased the system does not impact credit scores.

But Dr Tutt – who posted a video on social media “celebrating” her balance passing £100,000 – is unhappy about how long she will be paying it off for.

The 27-year-old says the debt is saddening when she compares it to that of older colleagues who paid their loans off when terms were more favourable.

Abbie Tutt

Abbie Tutt She characterises her debt as a tax. Dr Tutt told the BBC: “If you’re going to uni because it’s your passion and you are going to get a good job and be happy then you could justify it.

“But I am not comfortable with people being in that much debt and not getting a job.”

‘Ridiculous’

Chloe Field, the NUS’ vice president for higher education, said means testing of maintenance loans often leads to people from working class backgrounds ending up in the most debt, as they can claim more funding.

“They also generally pay back their loans slower, and therefore end up paying more in interest”, she told the BBC.

Save The Student‘s Mr Allingham added: “The prior revelation that one graduate had student loan debt of over £231,000 was a watershed moment, which makes it even more shocking that dozens of others also owe in excess of £200,000.”

The Conservatives say that while in government the party has frozen tuition fees and ensured no one pays back more than they borrowed in real terms.

However, like Labour, the Tories are not making any concrete new proposals on tuition fees or student debt.

Labour’s manifesto says the current higher education funding settlement “does not work” and promises that the party “will act to create a secure future for higher education”.

The Liberal Democrats want to reinstate maintenance grants for disadvantaged students immediately and review higher education finance. The Green Party proposes abolishing tuition fees, while Reform promises to scrap interest on student loans.

The Department for Education declined to comment due to pre-election period restrictions.

Additional reporting by Nadyne Dunkley, Kris Bramwell and Victoria Park-Froud.