7:00 am GMT tomorrow welcomes UK employment data for September.

Expectations heading into the event show economists forecast regular pay (excludes bonuses) to have fallen to 4.7% in the three months to September (y/y) from August’s reading of 4.9% (maximum and minimum estimate range between 4.8% and 4.6%), while pay that includes bonuses is expected to have ticked slightly higher to 3.9% in the three months to September (y/y) from 3.8% in August (maximum and minimum estimate range between 4.0% and 3.6%). The unemployment rate is expected to increase to 4.1% in the three months to September from August’s reading of 4.0% (maximum and minimum estimate range between 4.3% and 4.0%).

Bank of England: Markets pricing in a pause for december

In an 8-1 vote, the Bank of England’s (BoE) Monetary Policy Committee (MPC) announced another 25 basis point cut at last week’s meeting, which was widely expected by both markets and economists.

We have one more policy meeting this year on 19 December, and markets, at least for now, are leaning toward a pause (82% probability is assigned to a hold). According to the minutes, inflation is expected to remain elevated for longer than expected due to the recent budget expected to boost inflation by 0.5%. However, you may recall that CPI inflation data (Consumer Price Index) cooled more than expected in the twelve months to September to 1.7% (economists pencilled in 1.9% as the median estimate), down from 2.2% in August.

GBP outperforming ahead of the data

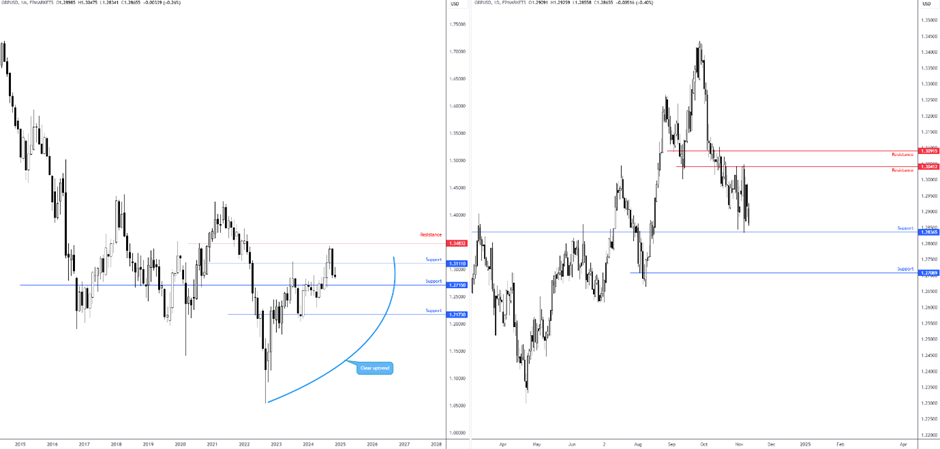

The GBP (British pound) has been a strong outperformer this year; as shown on the chart below, the GBP is outperforming all G10 peers, albeit the USD has been gaining strongly thanks to the ‘Trump Trade’.

However, in terms of CFTC positioning, demand for the GBP slowed from being strongly overstretched to the upside, though a miss in the data tomorrow could spark an unwind in remaining longs. Something else worth taking on board ahead of tomorrow’s print is that while the GBP continues to outperform, economic data has been surprising to the downside, according to the CitiFX Economic Surprise Index for the UK (see chart below). This has created a divergence between data and price.

How to trade the event?

As noted above, the GBP is still overstretched to the upside, with economic data surprising to the downside, thus offering clear divergence. The GBP (and rate pricing, for that matter) does not reflect what is happening with the data. It suggests more of a hawkish depiction.

With this being the case, for a dovish trade – to short the GBP and trade out of the upcoming risk event – traders will likely look for the unemployment rate to reach or surpass the market’s maximum estimate of 4.3%. You may also recall that should we see an unemployment rate of 4.3% or higher, this would also be north of the BoE’s updated forecast for Q4 24, which is now at 4.2% (down from August’s forecast of 4.4%). GBP sellers will also be likely looking for wages to come in at or below the market’s minimum estimates, as well as a drop in employment change.

Regarding potential short positions, technical studies also reveal room for bears to stretch their legs on the monthly scale until support coming in at US$1.2715. Adding to this, daily price is on the doorstep of retesting potentially vulnerable support from US$1.2837. While this level may persuade some buying, we must take into account that last week’s test of this support failed to drive things beyond resistance between US$1.3092 and US$1.3041, highlighting weakness from buyers and the possibility for follow-through downside towards support at US$1.2710 (located just beneath the monthly support target).

Nevertheless, a caveat to be aware of is the credibility of the data from the Office for National Statistics, which remains in question, though it still remains a market-moving print.