BBC

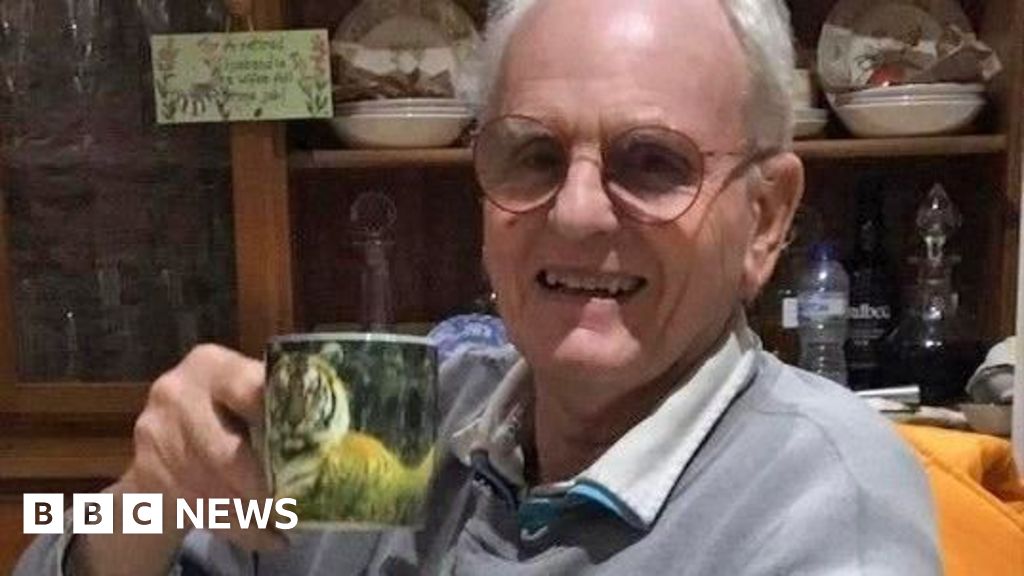

BBC“The money is just for the holiday kitty,” says Jon Harvey of the £300 he was given every winter to help with heating bills. “I could also use it to go out for a nice meal.”

The 80-year-old, like all pensioners in England and Wales, was given the winter fuel payment (WFP) automatically – until this week when the new Labour government voted to change the rules.

Now only pensioners who qualify for certain benefits will receive it, an estimated 1.5 million people. Last winter 10.8 million people got the payment.

Jon, a retired police officer, tells us “it’s about time” the rules changed as “there are people who need it more than me”.

The policy, launched by the last Labour government in 1997, costs nearly £2bn per year but Sir Keir Starmer hopes the changes will save taxpayers £1.5bn.

The prime minister says it could help plug the £22bn “black hole” he says exists in the national finances – but the Tories and charities fear it could leave some over-65s cold this winter.

Beyond the political fray, the argument is nuanced – so the BBC spoke to pensioners to hear the full range of views. Some told us they rely on the payment for heating, while others said they spend the money on things like holidays, restaurants or their grandchildren.

Olwen Jones, 70, has been receiving the payment for the last four years since retiring from her job in IT.

“I thought about giving it to my brother the last time I was given the payment, except he started getting it himself. Now, I give the money to charity,” she says.

The payment acts as a bonus to the bank balance for Nick Plowright. “My mother, who died back in 2019, was also receiving it for many years. When she did, she’d tell us to give it to the grandchildren,” the 68-year-old explains.

He adds: “The government needs to make the means testing rigorous, right minded and focused on helping those most in need. Above all, stop paying it to the millions who very obviously do not need it, like me.”

Comfortable – but not wealthy?

The issue of who needs the support is at the heart of the change to the WFP. Office for National Statistics (ONS) figures show that the proportion of wealthy over-65s has grown.

In 2010, 9% of this group lived in a household that had a total wealth – including assets like their home and pensions – above £1 million. Ten years later, this rose to 27%.

Liz Emerson, CEO of the Intergenerational Foundation, a charity that campaigns for youth-friendly government policy, says it is being fuelled by rising property values.

“Alongside that, they have more generous private pensions than young people,” she explains. “So when you combine housing wealth and pension wealth, older people have been doing far better than the younger generation over recent years.”

Yet this isn’t just about millionaires – many of those who say they do not need WFP, like those the BBC spoke to, are simply on healthy pensions after years of working.

Others are more wealthy, especially if they have sold high-value property and downsized to a house that is far less expensive to heat, ending up with leftover cash in the process.

For those who don’t sell up, Ms Emerson asks: “Should these pensioners be subsidised by younger taxpayers to stay in a valuable home? It seems to us to be intergenerationally unfair.”

The vast majority of over-65s receive a state pension and it’s the main income for those who don’t get a private pension – which their former employer paid into. The state pension increases every year through the triple lock – in line with whichever is highest out of inflation, earnings or 2.5%.

This year it increased by £690 for people who reached retirement age before April 2016 and £900 for those after that date. Next year the increases are projected to be £353 and £460 respectively, driven by high inflation and energy costs.

The government points out that these increases are worth more than the annual WFP payments, which is £300 for those who retired before April 2016 and £200 for those after.

Under the new rules, WFP will be paid only to over-65s who are receiving one of seven benefits: pension credit, universal credit, income-related employment and support allowance, income-based jobseeker’s allowance, income support, child tax credit or working tax credit.

Critics argue these alternative measures are not enough. Age UK estimates 2.5 million pensioners on low incomes – but not low enough to get pension credit – will struggle to pay their bills this winter.

The Conservatives and other opposition parties have criticised the government for not publishing an impact assessment that would have analysed which older people would have been most affected by the changes.

‘I’ll go to bed early to avoid the cold’

Shelagh Lind, 70, is £2 per week over the pension credit threshold, so will lose WFP. She now fears for the months ahead – and says she’s lost faith in Labour as a lifelong supporter of the party.

“I am so cross – I had that money earmarked and now it’s gone,” she says.

“I can’t predict how much the bills are going to be. We will suffer.”

Rose Brooks, 77, says her WFP money had been dedicated to paying the gas bill. “Without it, I cannot afford to put my central heating on. I honestly don’t know how I am going stay warm this winter.”

She adds: “I think I’m just going to have to go to bed early in hope of avoiding the coldest temperatures.”

Age UK have started a petition calling for the rule changes to be delayed – and more than 500,000 people have signed it.

Chris Brooks, head of policy at the charity, says: “The big problem is that a lot of pensioners, often those who are on very low incomes, don’t claim what they’re entitled to.

“Because they don’t claim these benefits, they won’t get the WFP. This puts them in a really difficult financial position and lots of them tell us that they won’t be able to turn their heating on this winter.”

Both Mr Brooks and Ms Emerson told us they are in favour of giving more support to pensioners on low incomes or those who are medically vulnerable.

And not just pensioners – others argue the payment should be widened to some families. Among them is Joan Jones, 76, who says the WFP sits in her bank account as she has “enough income to live on reasonably comfortably”.

“There are families with young children who are struggling,” she warns. “Whatever their age, those people who need it should have it first.”